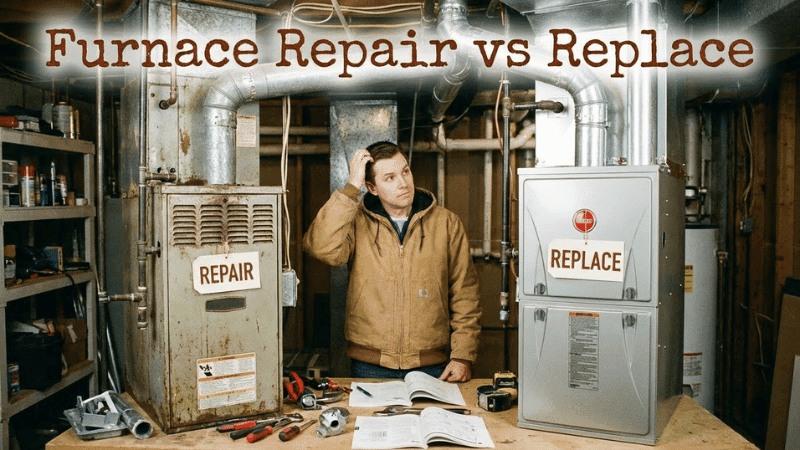

Does homeowners’ insurance cover HVAC

Owning a home is a big deal, right? It comes with a lot of good stuff, but also some headaches, like when things break down. Your HVAC system, which keeps your place warm in the winter and cool in the summer, is super important. But what happens if it suddenly stops working? Will your homeowners’ insurance help you out with the repair bill? It’s a common question, and honestly, the answer isn’t always a simple yes or no. Let’s break down when your policy might cover HVAC issues and when you’re on your own, especially if you’re looking for AC Repair in Tucson.

Understanding HVAC Systems and Homeowners’ Insurance

What is HVAC and Why is it Important?

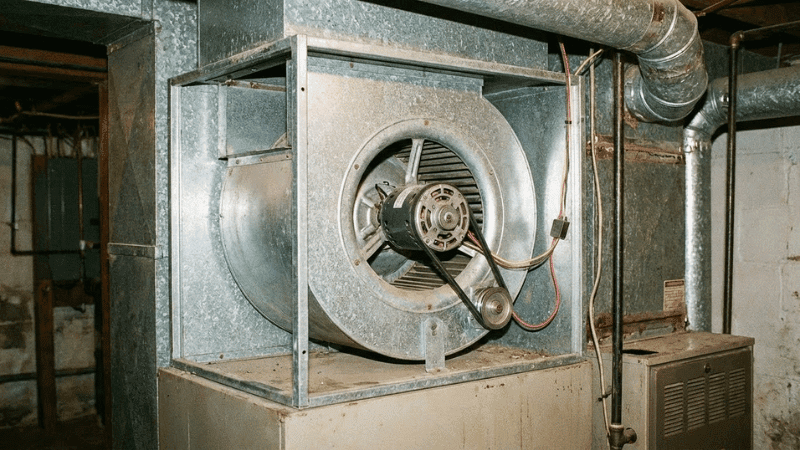

HVAC stands for Heating, Ventilation, and Air Conditioning. Basically, it’s the system that keeps your home comfortable year-round. We’re talking about everything from your furnace to your AC unit, and even the ductwork that distributes air throughout your house. A well-functioning HVAC system is important for maintaining good air quality, regulating temperature, and preventing moisture buildup, which can lead to mold issues.

Think of it this way:

- Heating keeps you warm in the winter.

- Air conditioning keeps you cool in the summer.

- Ventilation ensures fresh air circulates.

- Proper humidity control prevents mold and mildew.

Without a working HVAC system, your home could become uncomfortable or even unsafe. Imagine trying to sleep in the dead of summer with no AC, or dealing with freezing pipes in the winter because your furnace is on the fritz. Not fun!

Basic Homeowners’ Insurance Coverage Explained

Homeowners’ insurance is designed to protect your home and belongings from unexpected events. It typically covers things like fire, theft, vandalism, and certain types of weather damage. But what about your HVAC system? Well, it depends. Standard home insurance policies may offer some coverage for HVAC systems, but it’s not always a given.

Here’s the deal:

- Covered Perils: Insurance usually covers damage caused by specific events listed in your policy, like fire, lightning, or windstorms.

- Exclusions: Policies often exclude damage from wear and tear, lack of maintenance, or flooding.

- Deductibles: You’ll likely have to pay a deductible before your insurance kicks in.

It’s important to understand the difference between what’s covered and what’s not. For example, if a power surge fries your AC unit during a thunderstorm, your insurance might cover the cost of repairs or replacement. However, if your furnace breaks down because you haven’t had it serviced in ten years, you’re probably on your own. You might want to consider adding equipment breakdown coverage to your policy for broader protection against potential mechanical failures of your HVAC system. Review your policy carefully to understand the specifics of your coverage. It’s also a good idea to keep up with regular furnace maintenance to prevent issues in the first place.

When Does Insurance Cover HVAC Damage?

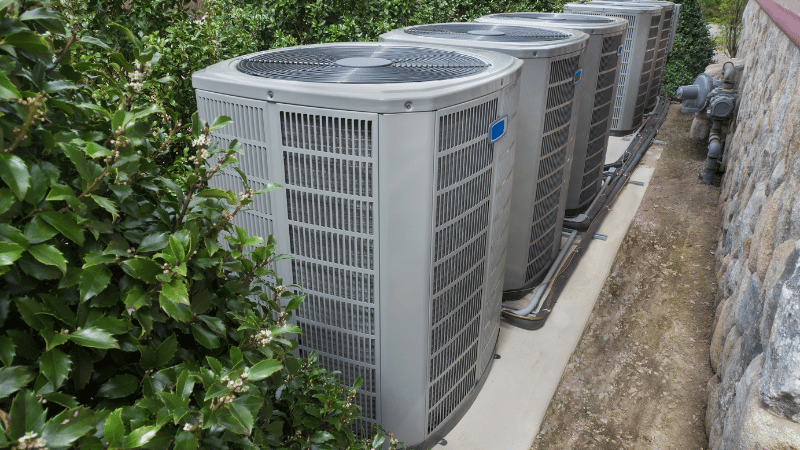

Covered Perils: Sudden and Accidental Damage

Homeowners insurance is there to protect you from the unexpected. When it comes to your HVAC system, that generally means coverage kicks in when damage is caused by a covered peril. These are sudden and accidental events, not gradual wear and tear. Think of it this way: if something happens to your HVAC, you’re likely in good shape. If it slowly deteriorates, not so much.

- Fire: A fire in your home that damages the HVAC system is almost always covered.

- Vandalism: If someone vandalizes your outdoor AC unit, that’s a covered event.

- Falling Objects: A tree falling on your AC unit? Covered.

It’s important to remember that filing a claim should be done promptly. Document everything with photos and repair estimates to make the process smoother.

Examples of Covered HVAC Damage

Let’s get into some specific scenarios. Imagine a bad storm rolls through. Here’s how insurance might respond:

- Lightning Strike: A direct lightning strike fries the electrical components of your central AC. Your home insurance should cover the repair or replacement, minus your deductible.

- Hail Damage: Large hailstones damage the fins on your outdoor condenser unit, reducing its efficiency. This is generally covered.

- Vehicle Impact: A car accidentally crashes into your house and damages the outside unit. The driver’s liability insurance should cover the damage, but your homeowner’s policy can step in if needed.

Here’s a quick table to illustrate:

| Scenario | Covered? | Notes

When is HVAC Damage NOT Covered by Insurance?

Exclusions: Wear and Tear, Neglect, and Maintenance Issues

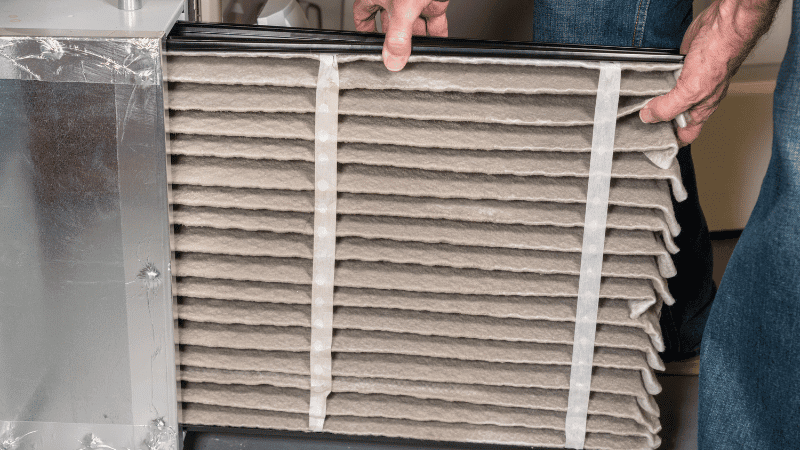

Homeowners insurance is great, but it’s not a free pass for everything that can go wrong. When it comes to your HVAC system, there are definitely situations where you’re on your own. The big one is wear and tear. Think about it – your HVAC runs constantly, and parts are going to break down over time. Insurance companies see this as inevitable, not accidental, so they usually won’t cover it. Same goes for neglect. If you don’t bother to change the filters or get regular check-ups, and your system fails as a result, that’s on you. It’s like not changing the oil in your car – you can’t expect insurance to pay for a blown engine if you’ve been ignoring basic maintenance. Manufacturer defects are also usually not covered; those fall under the manufacturer’s warranty, if you have one.

Here’s a quick rundown:

- Normal wear and tear

- Lack of maintenance

- Manufacturer defects

It’s important to keep up with regular HVAC maintenance. A little bit of preventative care can save you a lot of money and headaches down the road. Plus, it can help you avoid situations where your insurance claim is denied.

Damage from Flooding or Earthquakes (Separate Policies Needed)

Another big area where homeowners insurance often falls short is damage from natural disasters like floods or earthquakes. Standard policies just don’t cover these events. If you live in an area prone to flooding, you’ll need to get a separate flood insurance policy. Similarly, if you’re in earthquake country, you’ll want to look into earthquake insurance. These policies can be pricey, but they’re worth it if you want to protect your HVAC system (and the rest of your home) from these specific risks. It’s also worth noting that even if a covered peril, like a hail storms, causes a flood that damages your HVAC, the flood damage itself won’t be covered without that separate flood policy.

Tips for Homeowners: Maximizing Your Coverage and Preventing Issues

Regular HVAC Maintenance is Key

It’s easy to forget about your HVAC system until something goes wrong, but regular maintenance is the best way to prevent costly repairs and ensure your system runs efficiently. Think of it like taking your car in for an oil change – a little preventative care can save you from major headaches down the road. Here’s a simple checklist:

- Change your air filters every 1-3 months. A dirty filter restricts airflow and makes your system work harder.

- Schedule a professional HVAC inspection and tune-up at least once a year. They can catch small problems before they become big ones.

- Keep the area around your outdoor unit clear of debris. This ensures proper airflow.

Neglecting regular maintenance can lead to denied claims if the damage is deemed preventable. Insurance companies often require homeowners to take reasonable steps to protect their property.

Reviewing Your Policy and Understanding Deductibles

Don’t wait until disaster strikes to understand your homeowners insurance coverage. Take the time to carefully review your policy and understand what’s covered and what’s not. Pay close attention to the following:

- Coverage Limits: What’s the maximum amount your insurance company will pay out for a covered loss? Make sure it’s enough to cover the cost of replacing your HVAC system.

- Deductibles: How much will you have to pay out-of-pocket before your insurance kicks in? A higher deductible usually means a lower premium, but make sure you can afford to pay it if something happens.

- Exclusions: What perils are specifically excluded from coverage? Common exclusions include wear and tear, neglect, and damage from floods or earthquakes.

It’s also a good idea to shop around and compare quotes from different insurance companies. You might be surprised at how much prices can vary. Consider adding equipment breakdown coverage for broader protection against potential mechanical failures of your HVAC system.

Conclusion

So, what’s the big takeaway here? Your homeowners insurance can definitely help out with HVAC problems, but it’s not a magic fix for everything. It’s mostly there for those sudden, unexpected things, like if a tree falls on your outdoor unit or a fire messes things up. But if your system just quits because it’s old, or you forgot to change the filter for five years, that’s usually on you. The best thing you can do is really get to know your policy. Read the fine print, ask your insurance agent questions, and maybe even think about adding extra coverage if you’re worried. And hey, keeping up with regular maintenance on your HVAC system can save you a ton of headaches (and money) in the long run. A little bit of effort now can prevent a big, expensive surprise later.

Key Takeaways

- Homeowners’ insurance usually covers HVAC damage if it’s from a sudden, unexpected event, like a fire or a lightning strike.

- Things like normal wear and tear, not keeping up with maintenance, or problems from the factory are typically not covered by your standard policy.

- For damage from floods or earthquakes, you’ll need separate insurance policies; your regular homeowners’ insurance won’t cover these.

- Doing regular maintenance on your HVAC system is a smart move to keep it running well and avoid costly repairs that insurance won’t pay for.

- Always read your insurance policy carefully to understand what’s covered and what your deductible is, so there are no surprises.

Frequently Asked Questions

What does HVAC mean?

HVAC stands for Heating, Ventilation, and Air Conditioning. These systems are super important because they keep your home at a comfy temperature all year round, making sure you have warm air in winter and cool air in summer. They also help with air quality.

When does my insurance cover HVAC damage?

Generally, homeowners insurance helps pay for HVAC damage if it’s caused by something sudden and unexpected, like a fire, a tree falling on it, or a lightning strike. It’s for accidents, not just things wearing out over time.

What kind of HVAC damage isn’t covered?

Your insurance usually won’t cover damage from normal wear and tear, like if your unit just gets old and stops working. It also won’t cover problems caused by not taking care of your HVAC, or if it has a problem from the factory. Things like floods or earthquakes are also usually not covered by standard policies.

Is it important to maintain my HVAC system?

Yes, regular check-ups and cleaning are super important! Keeping your HVAC system in good shape can prevent many problems and help it last longer. Plus, if you don’t maintain it, your insurance might not cover damage that could have been avoided.

What is a deductible?

A deductible is the amount of money you have to pay out of your own pocket before your insurance starts to pay. For example, if you have a $1,000 deductible and your HVAC repair costs $3,000, you’d pay the first $1,000, and your insurance would pay the remaining $2,000.

How can I understand my policy better?

You should always read your insurance policy carefully to understand what’s covered and what’s not. If you’re not sure, call your insurance company or agent and ask them to explain it. It’s better to know before something happens!